The Model Audiobook

Supplementary Graphics & Charts

Thank you for taking the time to visit this audiobook companion.

To enrich your listening experience of The Model, we are pleased to offer the following photographs, charts, tables, and graphics that accompany the Overlook story. Also, The Model includes a short chapter titled “Equations: A Component of Overlook’s Success,” which presents the equations Overlook utilizes to assist in the financial analysis of companies. As equations do not communicate effectively in verbal form, that chapter is omitted from the audiobook, but available in the content below.

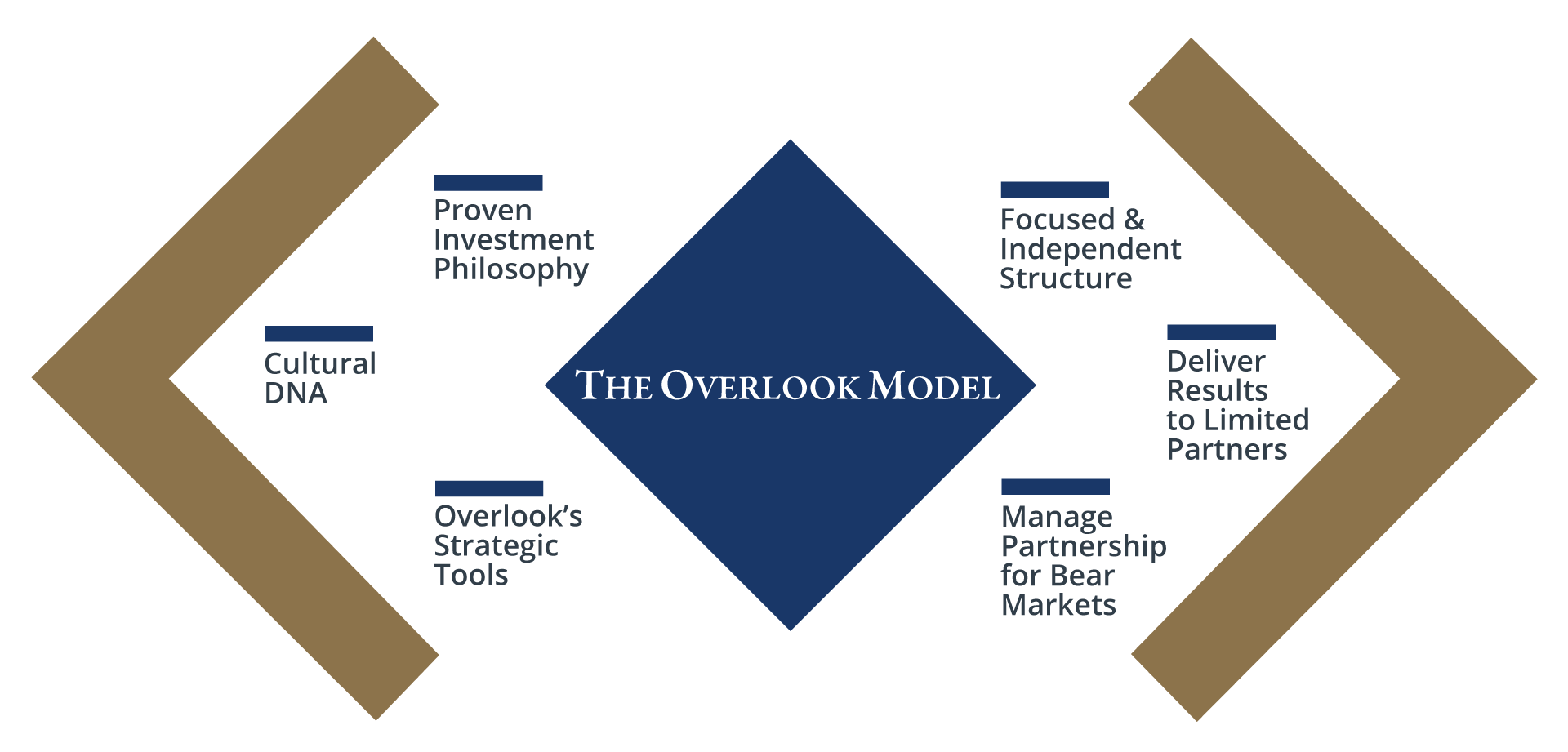

The Overlook Model, as first rendered in 1991, is formed around six interlocking components.

The Model

Part One – Bear Markets

Chapter 1 – Voracious! The 1997/98 Asian Crisis

Chapter 2 – Lessons from Bear Markets

Chapter 1: Voracious! The 1997/98 Asian Crisis

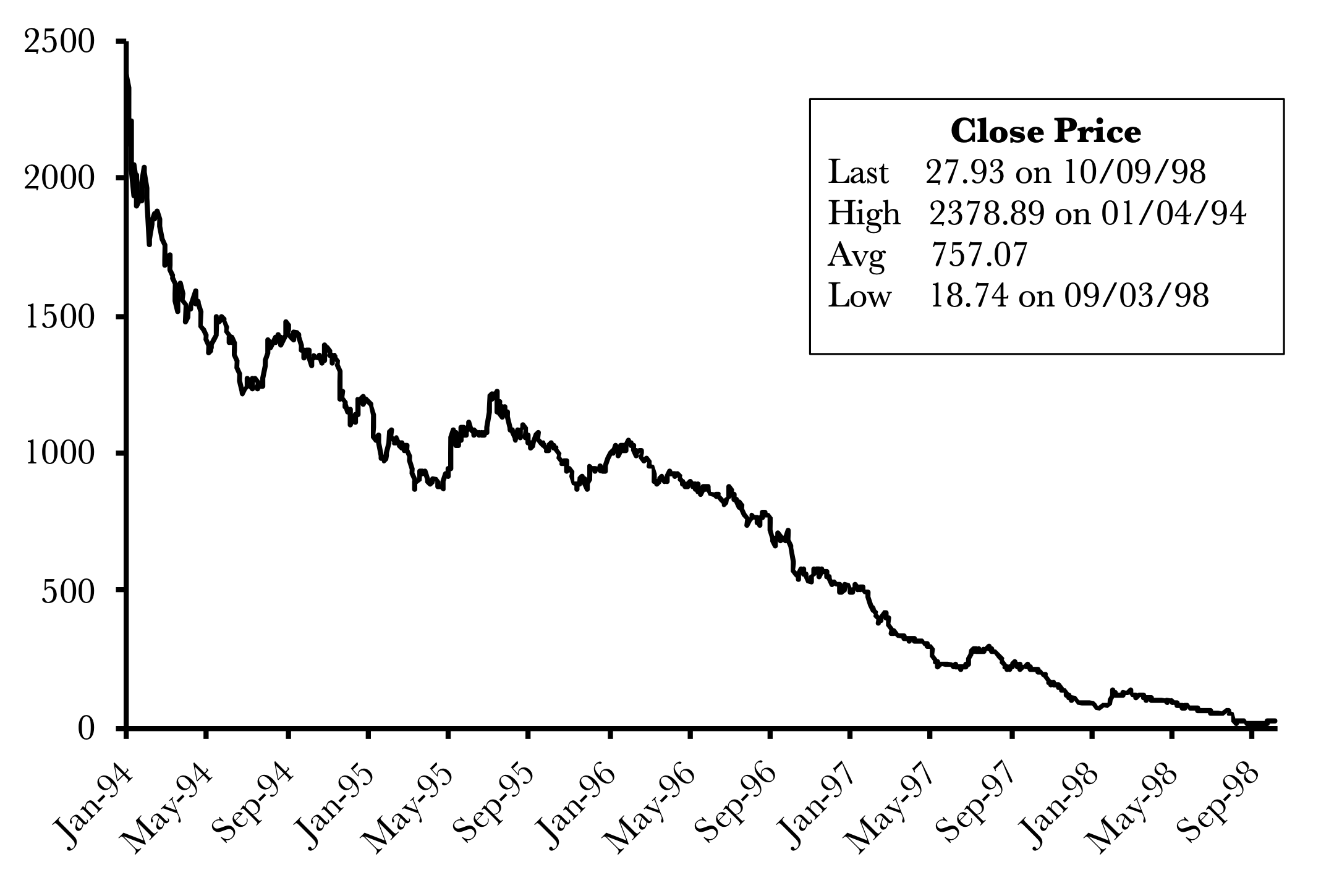

The collapse in values during the Asian Financial Crisis was breathtaking. For example, as shown in this chart, in the lead-up to the Crisis, the Thai Property submarket dropped by 99.3%.

Chapter 2: Lessons from Bear Markets

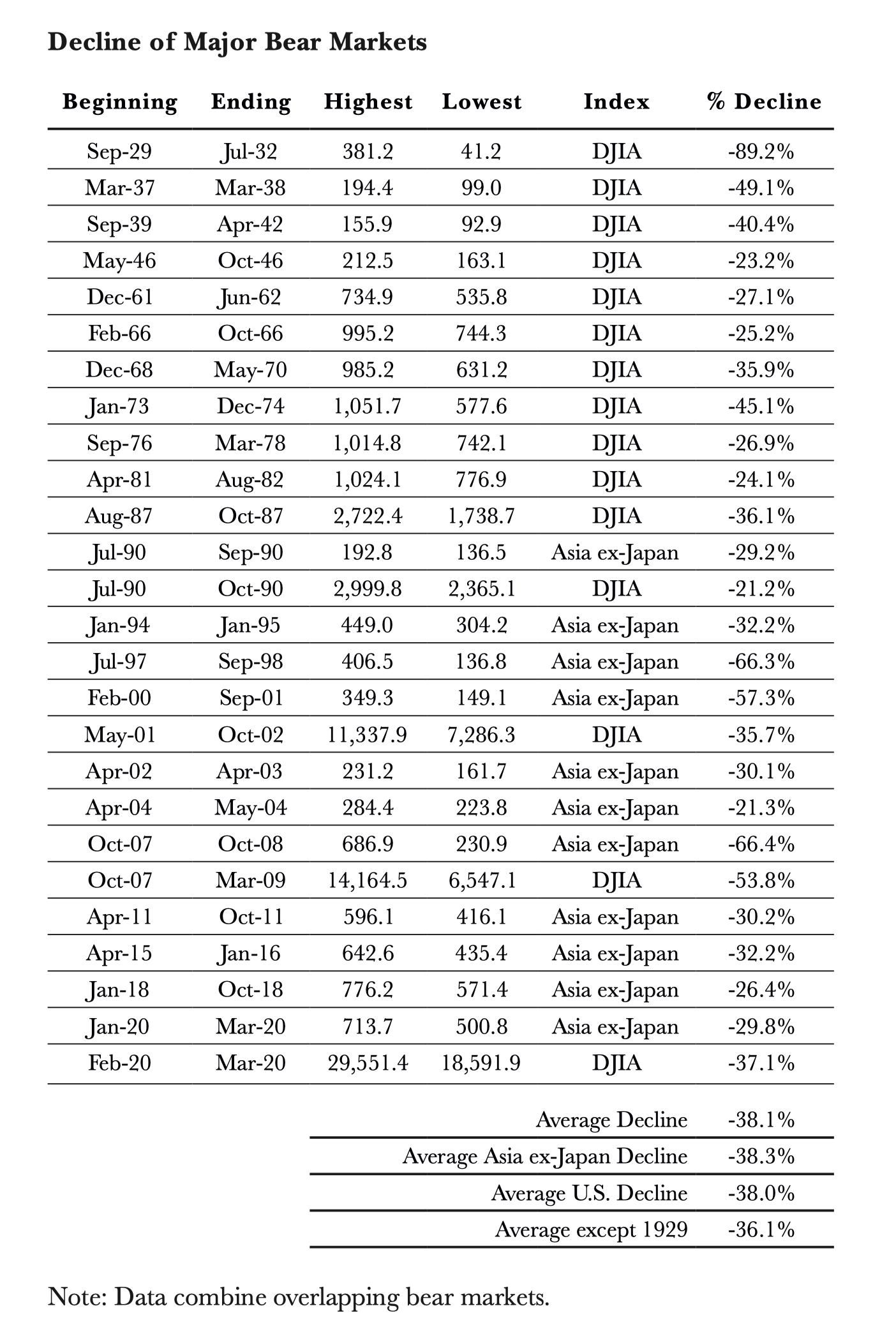

In 26 major bear markets from 1929 to today, the average stock market decline was 38.1%. The 11 bear markets in Asia since 1990 have brought average declines of 38.3%, including declines of over 66% in 1997/98 and 2007/08.

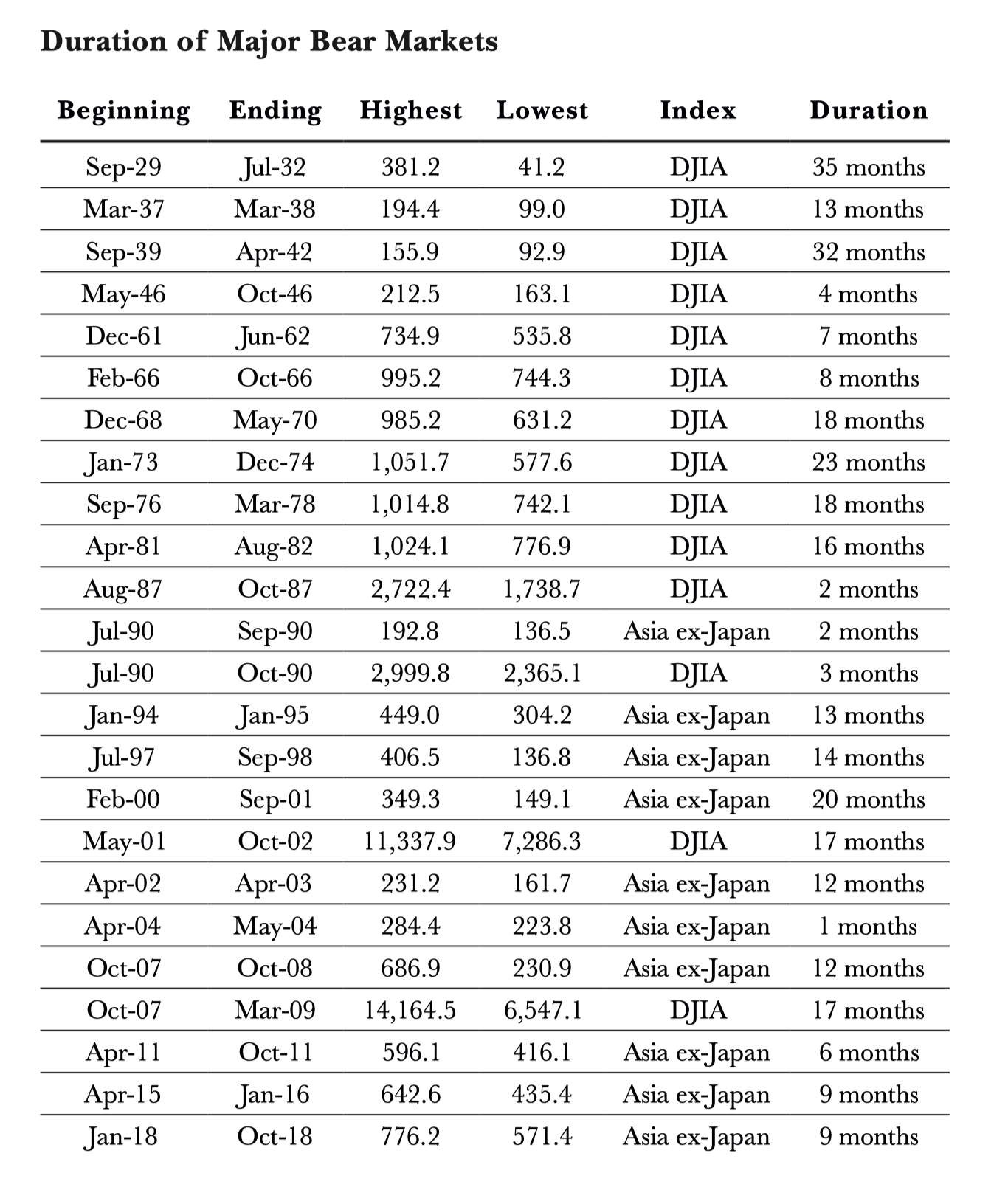

…But Bear Markets End

The duration of the 14 most recent bear markets has ranged from 20 months, during the Tech Bubble in 2000–01, to a single day in October 1987. The average duration, excluding 1987, has been 10.1 months. The average of 26 bear markets in the U.S. and Asia going back to 1929 is 14.5 months.

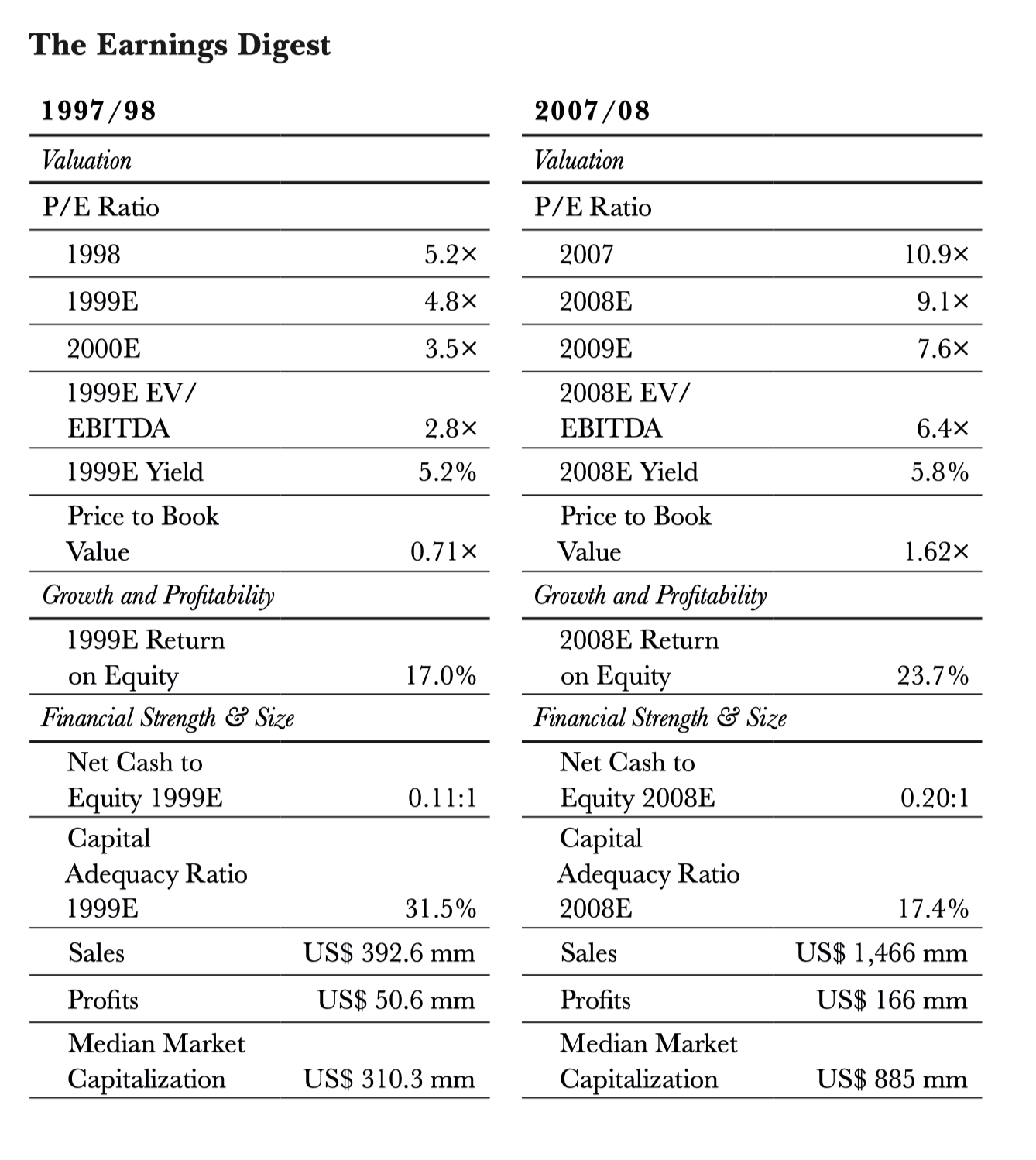

The more severe the bear market, the more dramatic the investment opportunities. In 1999, the valuation of the Overlook portfolio was 4.8 times current E.P.S. estimates; in 2009, the valuation was 7.6 times current E.P.S. estimates. From the low base of those valuations, Overlook compounded gains at 17.9% and 32.2% during the first five years after the 97/98 and 07/08 Bear Markets, respectively.

The Model

Part Two – The Overlook Model

Chapter 3 – The Overlook Investment Philosophy

Chapter 4 – Failure to Deliver

Chapter 5 – The Overlook Business Practices

Chapter 5 – The Overlook Margin of Safety

Chapter 7 – Equations: A Component of Overlook’s Success

Chapter 8 – Modern Finance Technology

Chapter 3: The Overlook Investment Philosophy

The Investment Philosophy from Overlook’s first presentation in 1992. Today, the Investment Philosophy remains unchanged except for a few words.

Past Predicts Future: Fuyao Glass

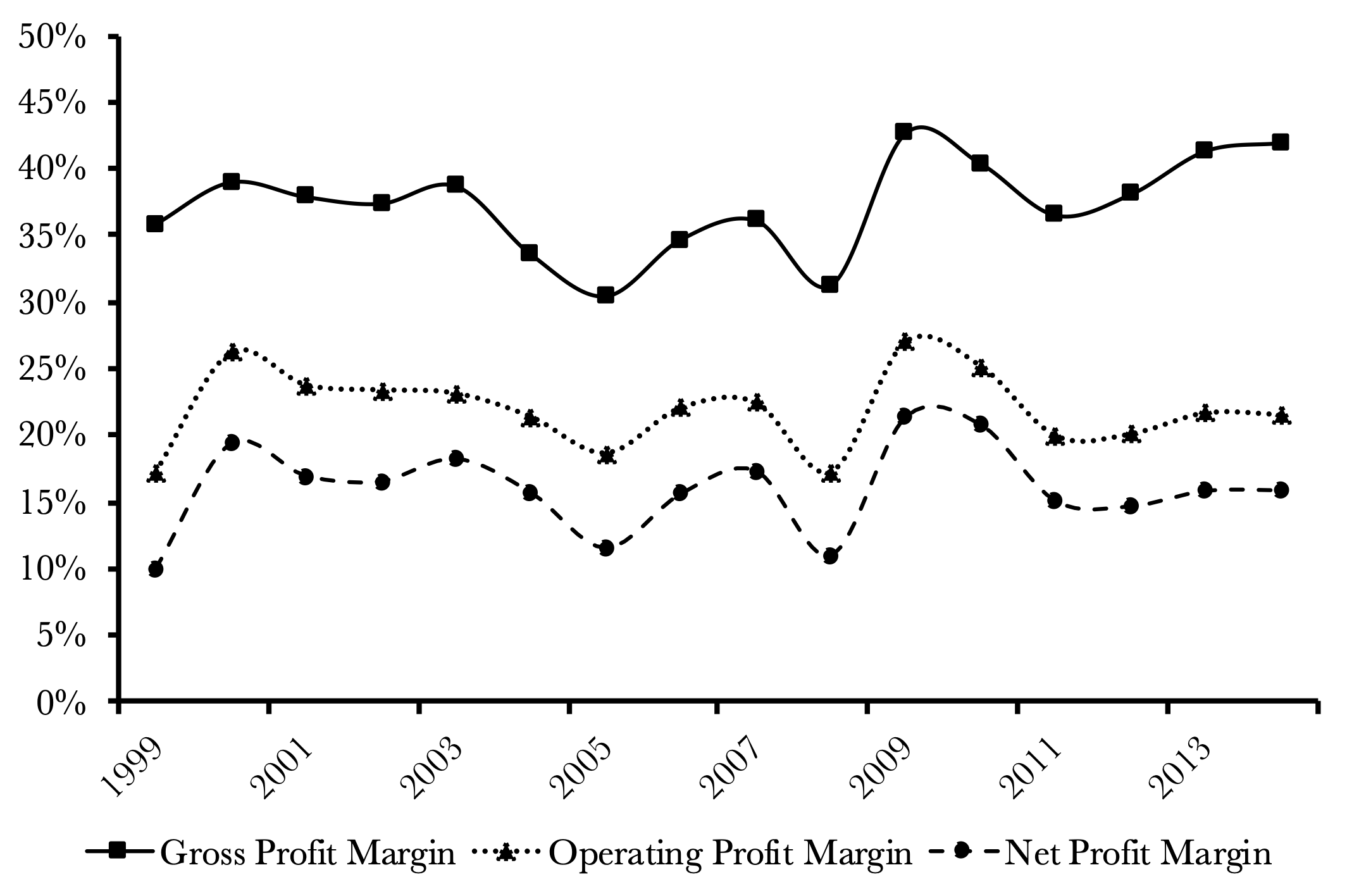

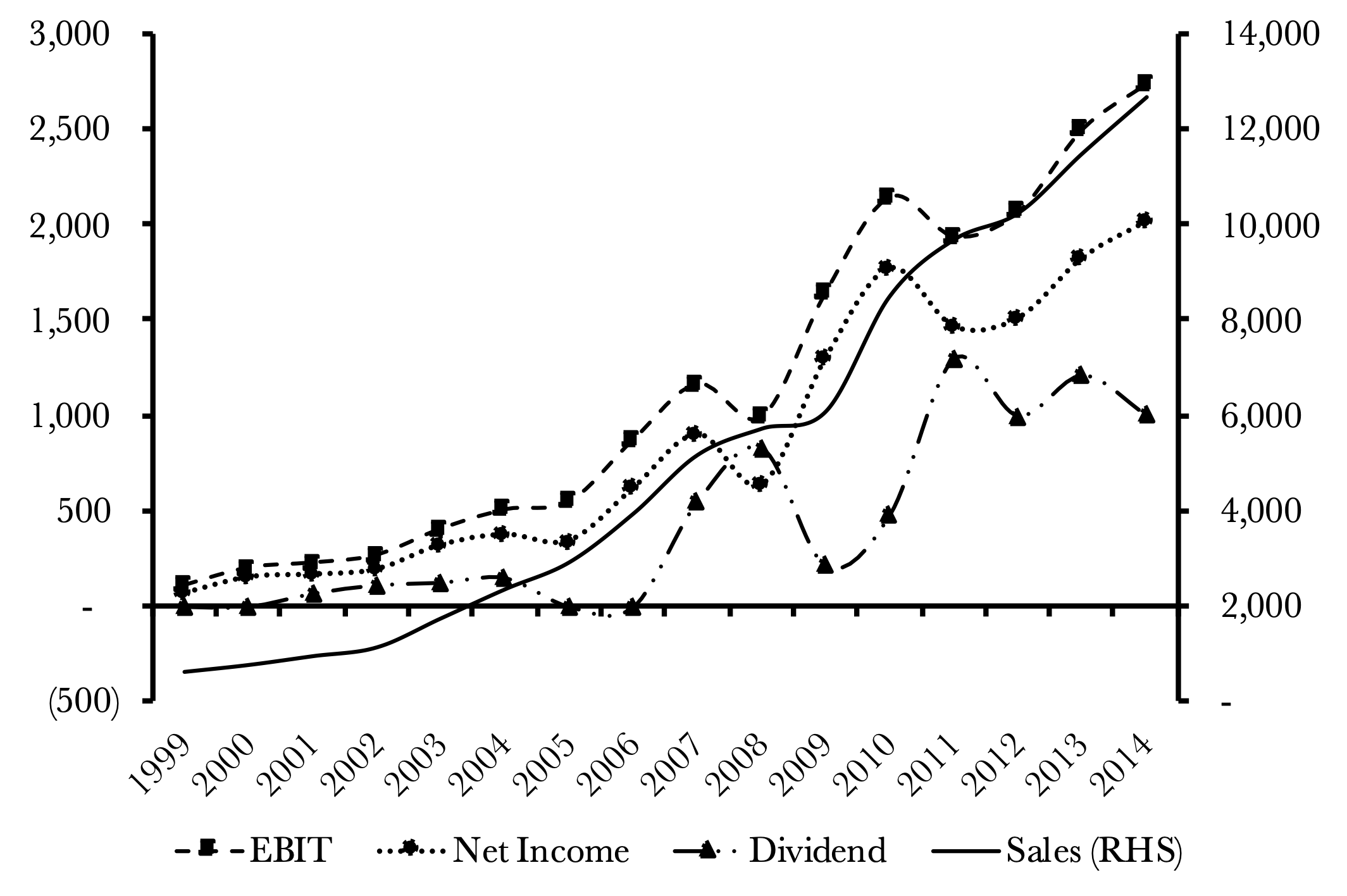

These two charts depict the impressive track record of Fuyao Glass over the 15-year period leading up to our decision to invest.

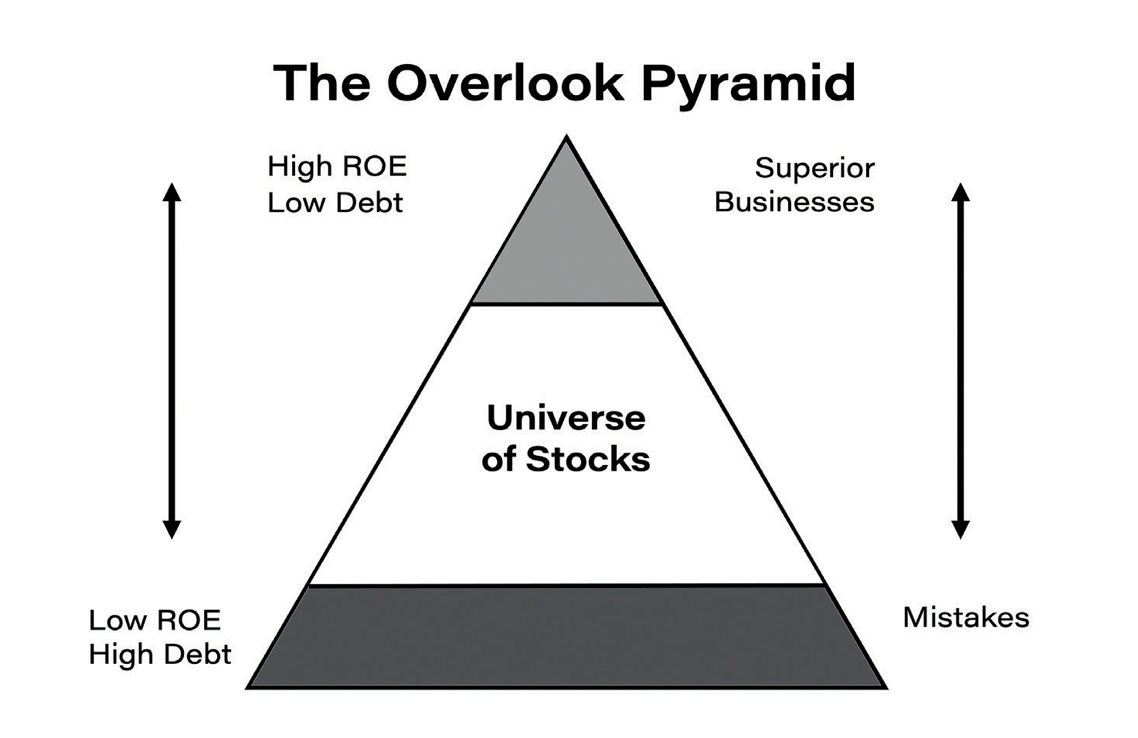

If investors can push their portfolio toward the Top of the Pyramid and keep it there, subject to three caveats, then that portfolio is positioned to generate outperformance over the universe.

Chapter 6: The Overlook Margin of Safety

The Path to Outperformance

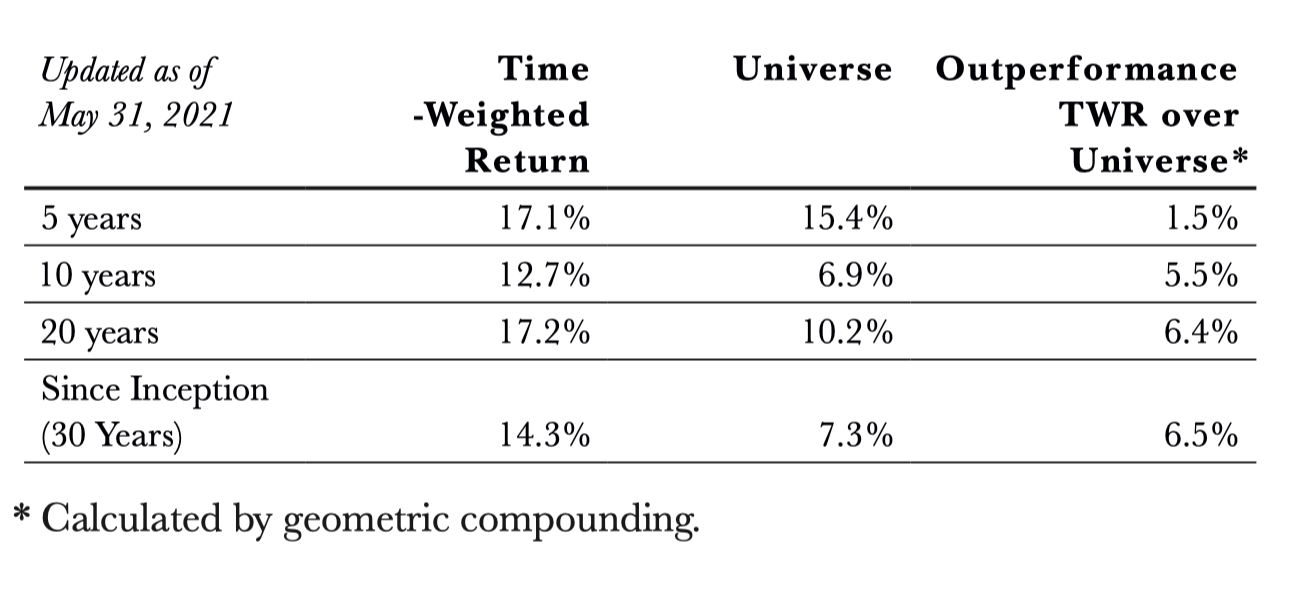

The Investment Philosophy Delivers Superior Time-Weighted Returns

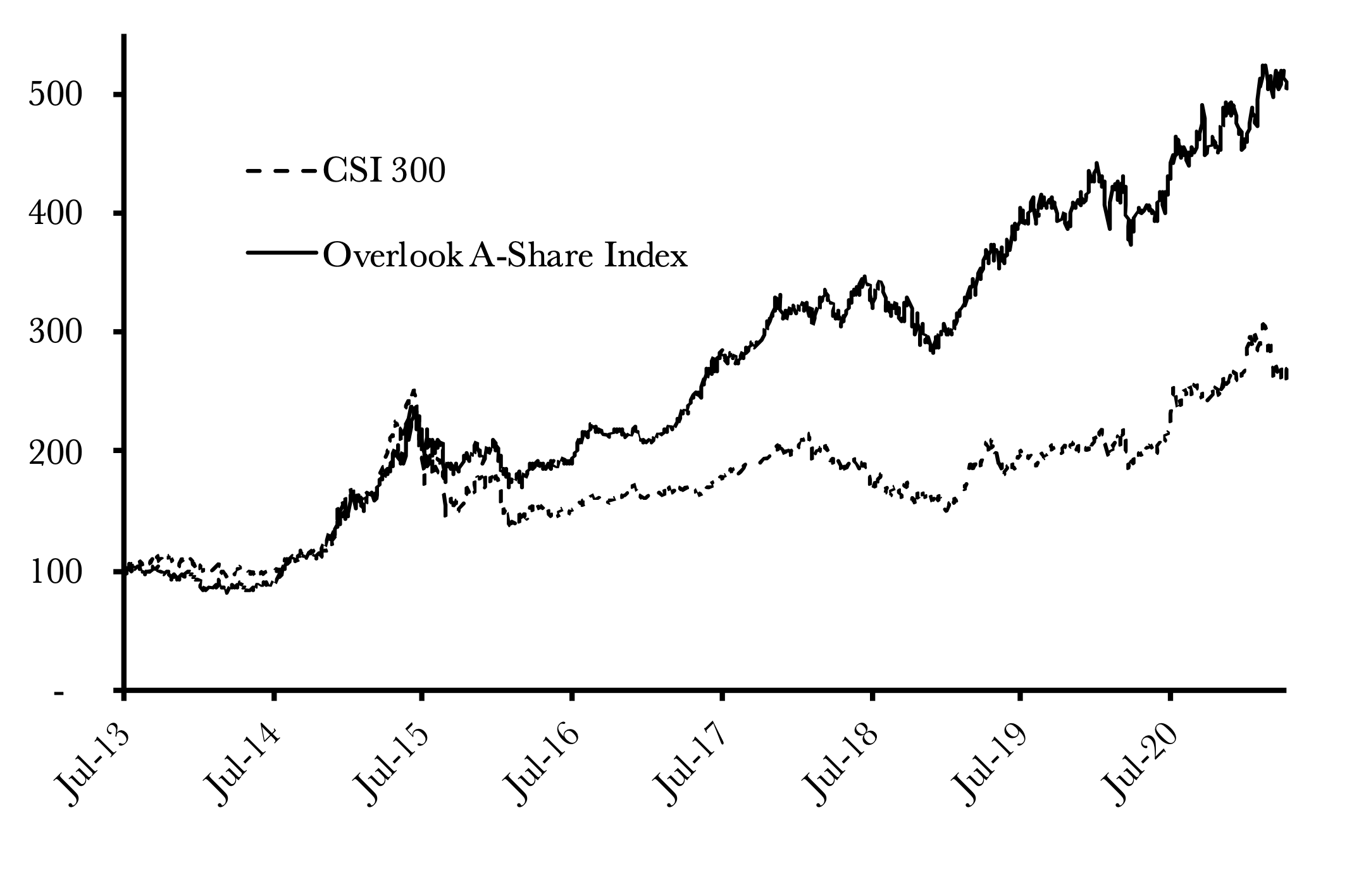

Due to the successful execution of the Investment Philosophy, Overlook’s 14.3% time-weighted returns beat the benchmark by 6.5 percentage points per year for nearly 30 years.

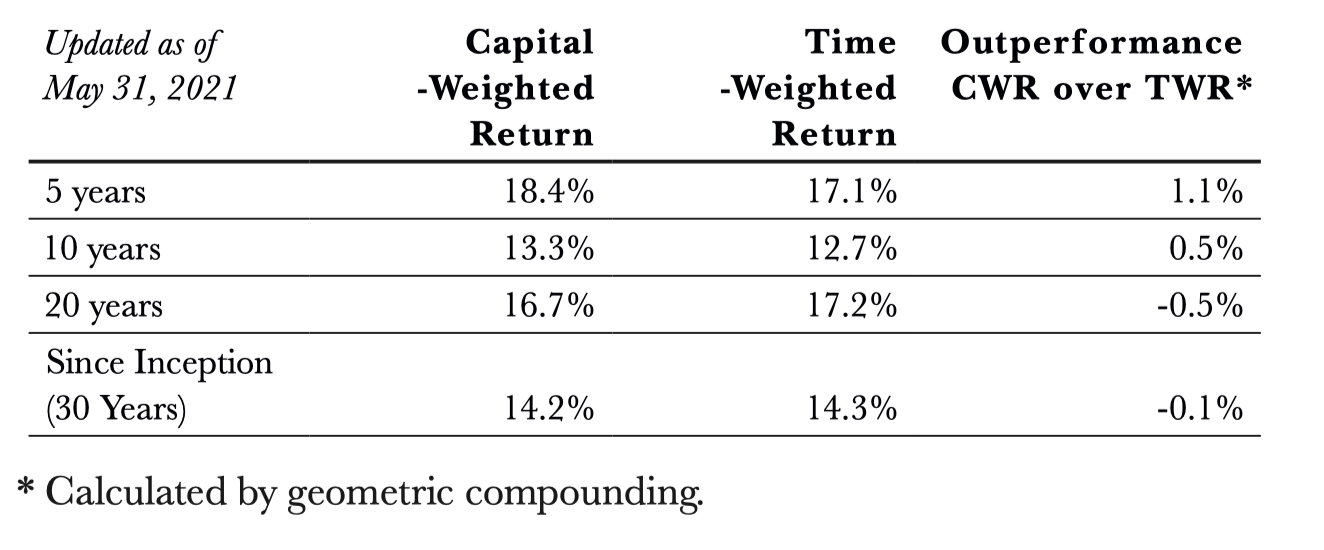

Business Practices Deliver Capital Weighted Returns to Investors

Due to the execution of the Overlook Business Practices, Overlook’s capital weighted returns have nearly met or exceeded the time-weighted returns consistently over three decades.

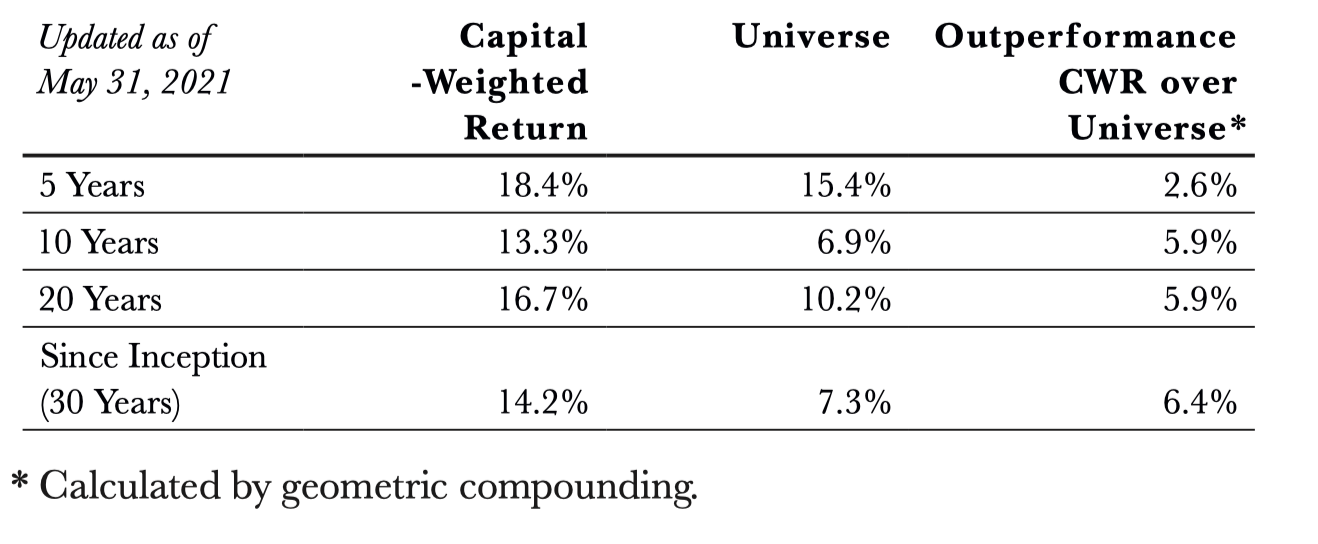

Investment Philosophy + Business Practices = The Overlook Margin of Safety

Overlook’s ability to nearly guarantee the delivery of outperformance to its investors can only be explained by the confluence of our Investment Philosophy with our Business Practices to create the Overlook Margin of Safety.

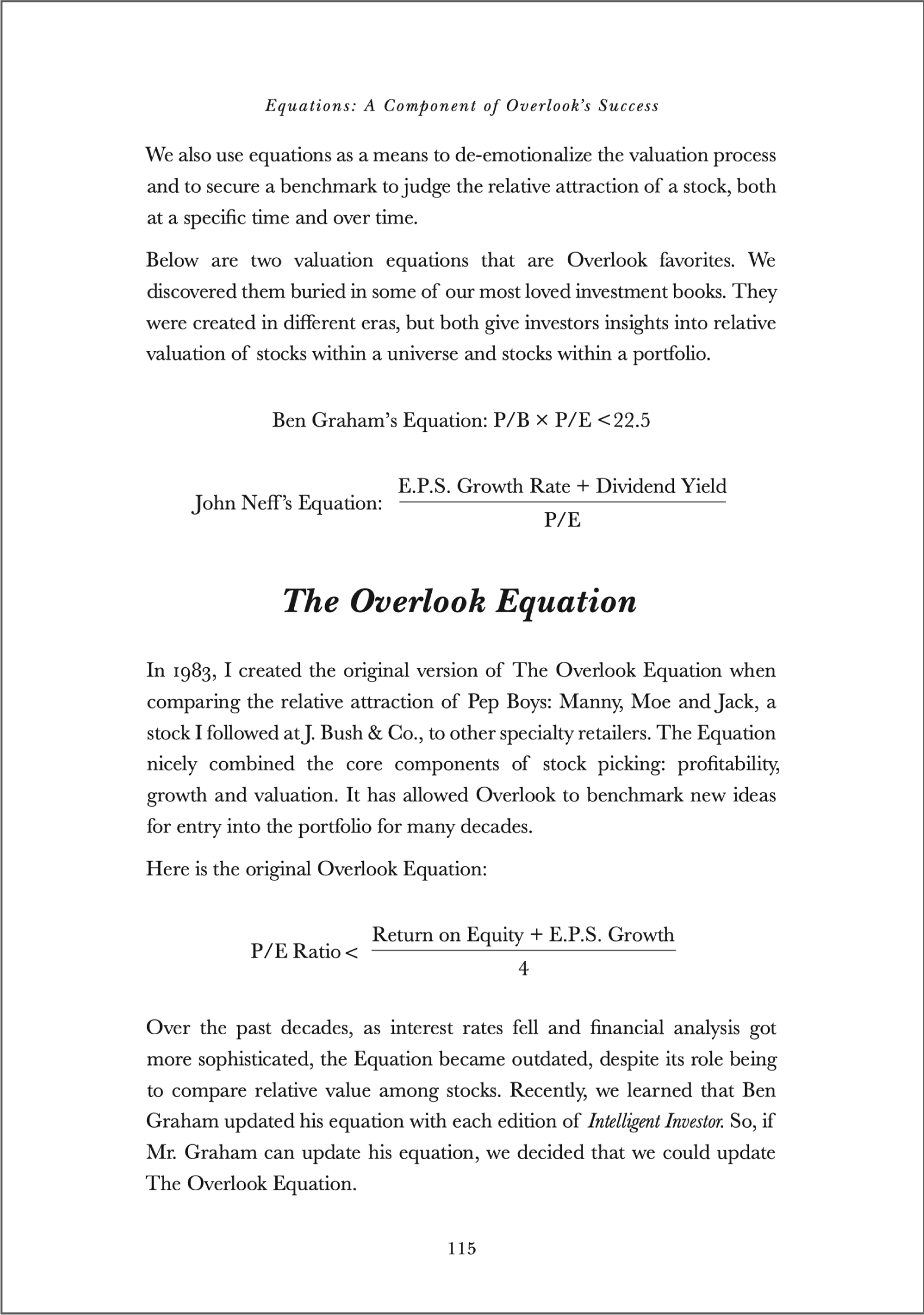

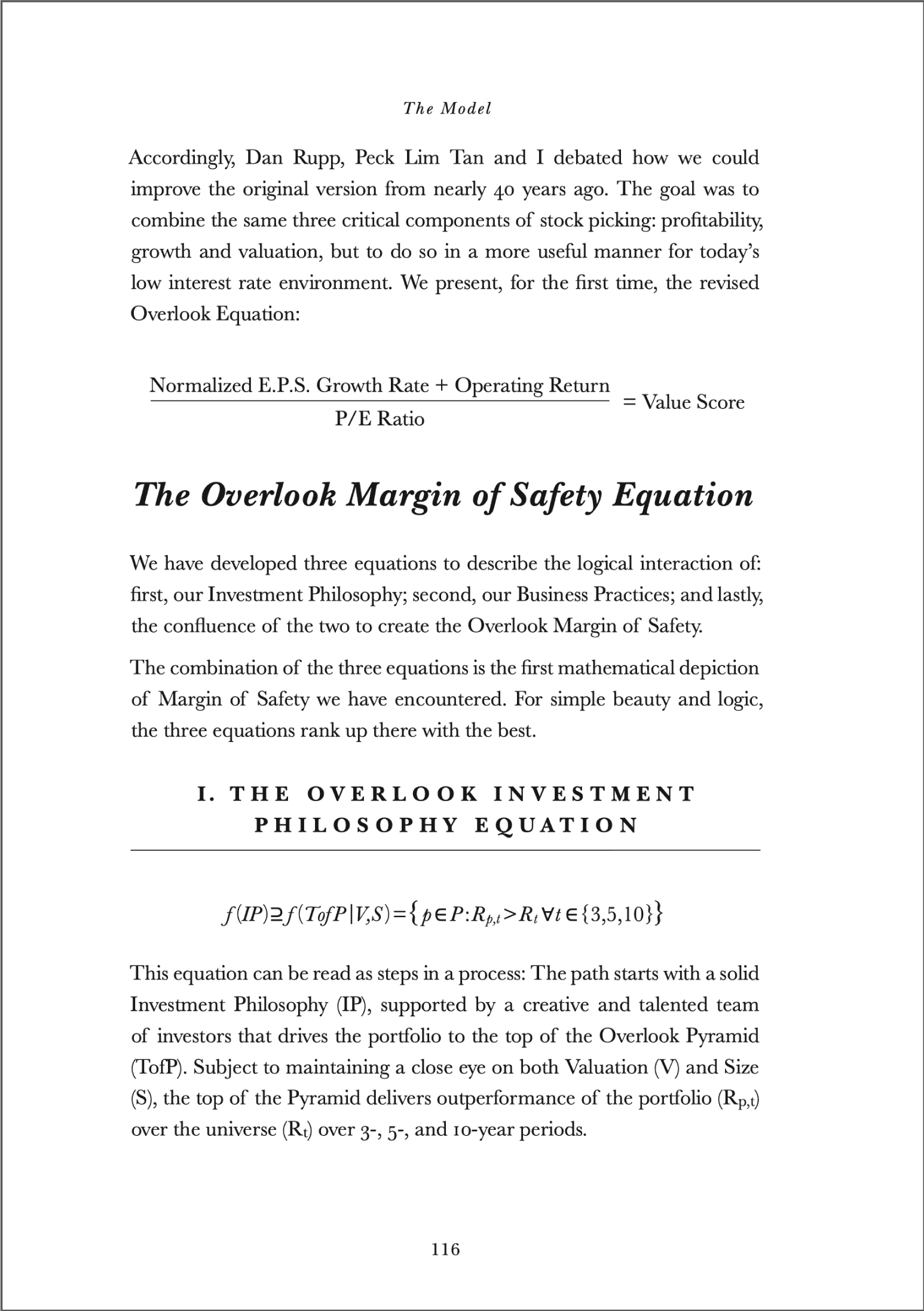

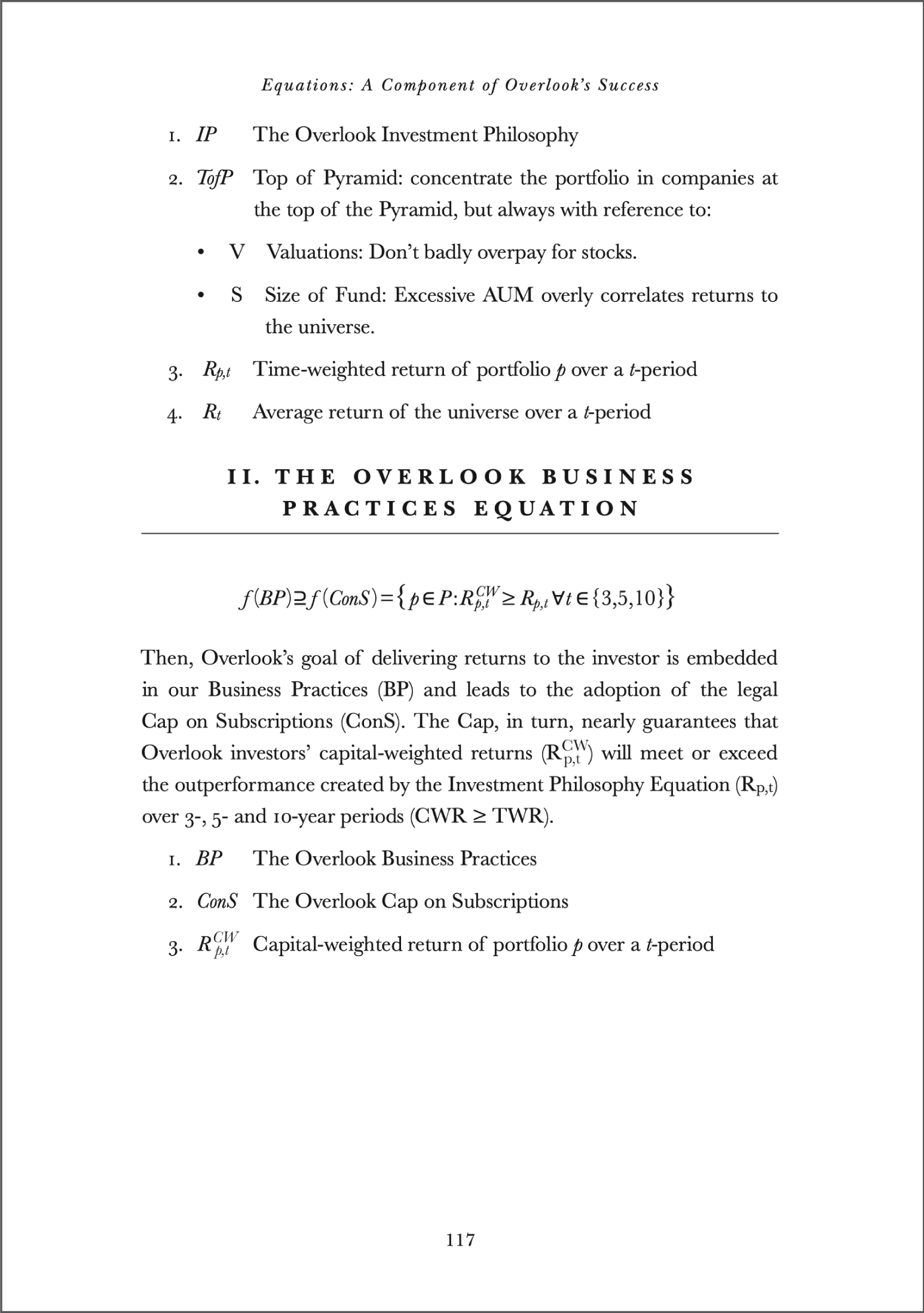

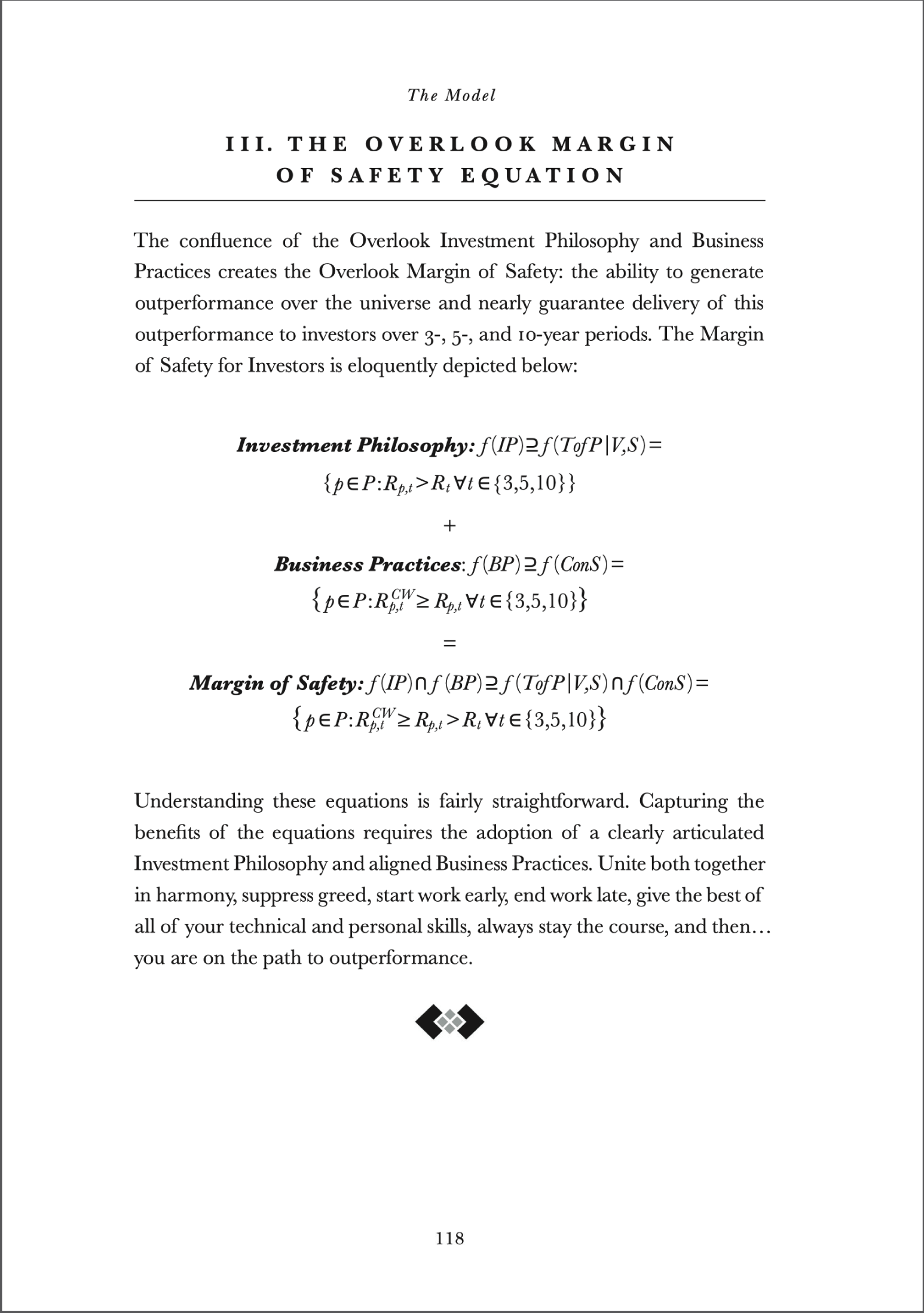

Chapter 7: Equations: A Component of Overlook’s Success

The Model

Part Three – Overlook in China from 1985-2000

Chapter 9 – Chasing Rainbows: China 1985-2000

Chapter 11 – The Hunt: China 2013-2021

Chapter 9: Chasing Rainbows: China 1985-2000

Oh, the possibilities of China! In 1988, while I was still working at FP Special Assets, we bought a stake in a company that controlled a massive swath of land in the Shenzhen Special Economic Zone that sold for less than a tenth of the price of land in Hong Kong. Had the company been able to keep the land, it would have created one of the great real estate fortunes in Asia.

China Overseas Town in—1985

and today

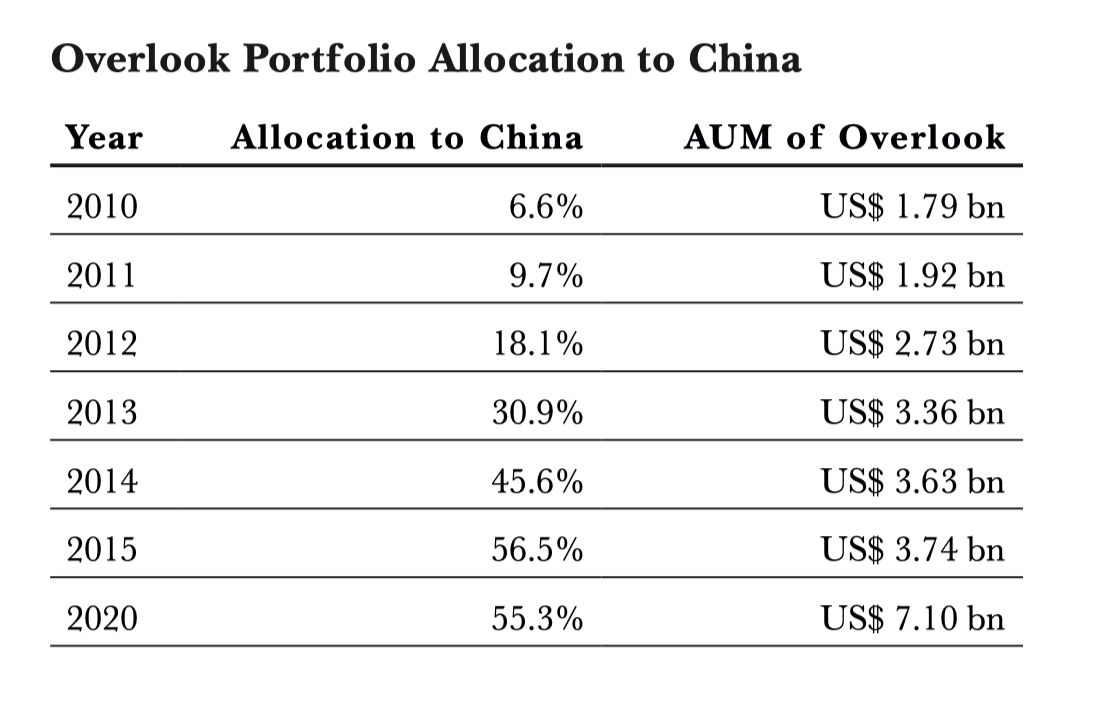

Chapter 11: The Hunt: China 2013-2021

A Stock Pickers Paradise

By 2013, after seven years of declining share prices in China, Overlook was at last finding companies that had the size and sophistication to handle China’s enormous potential, and we were able to invest in China on our own terms.

The Thrill of the Hunt! For Overlook in China, the opportunities kept coming and we kept buying.

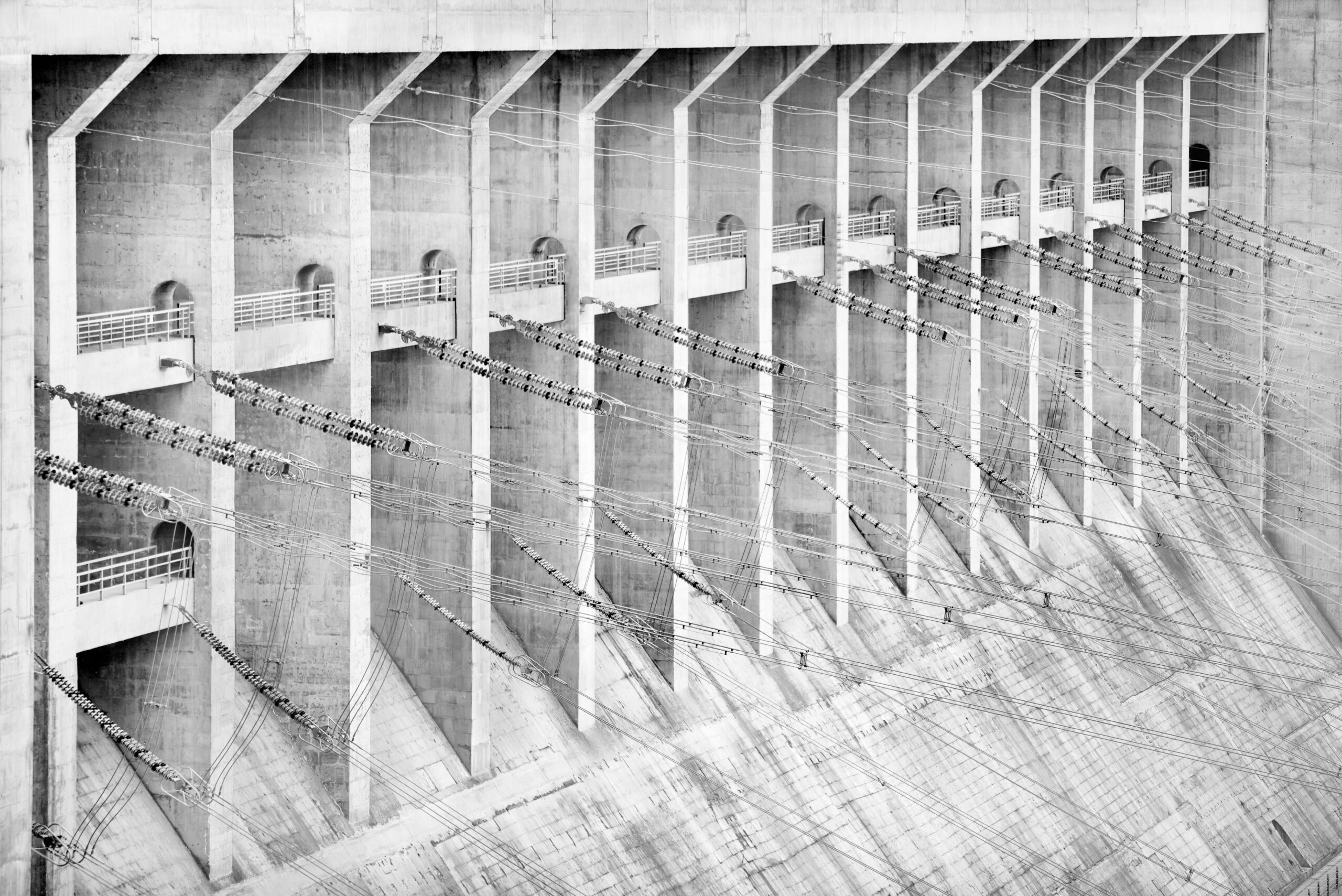

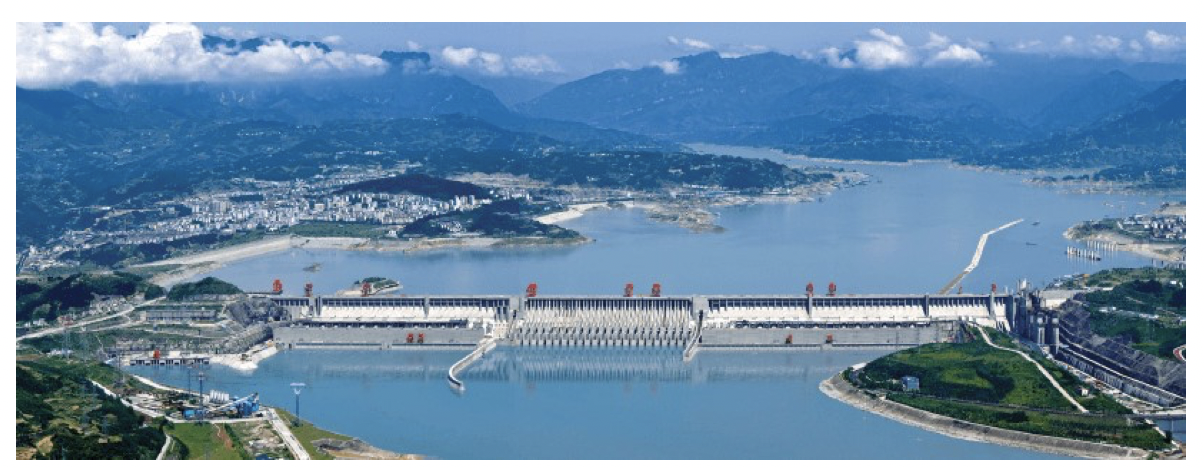

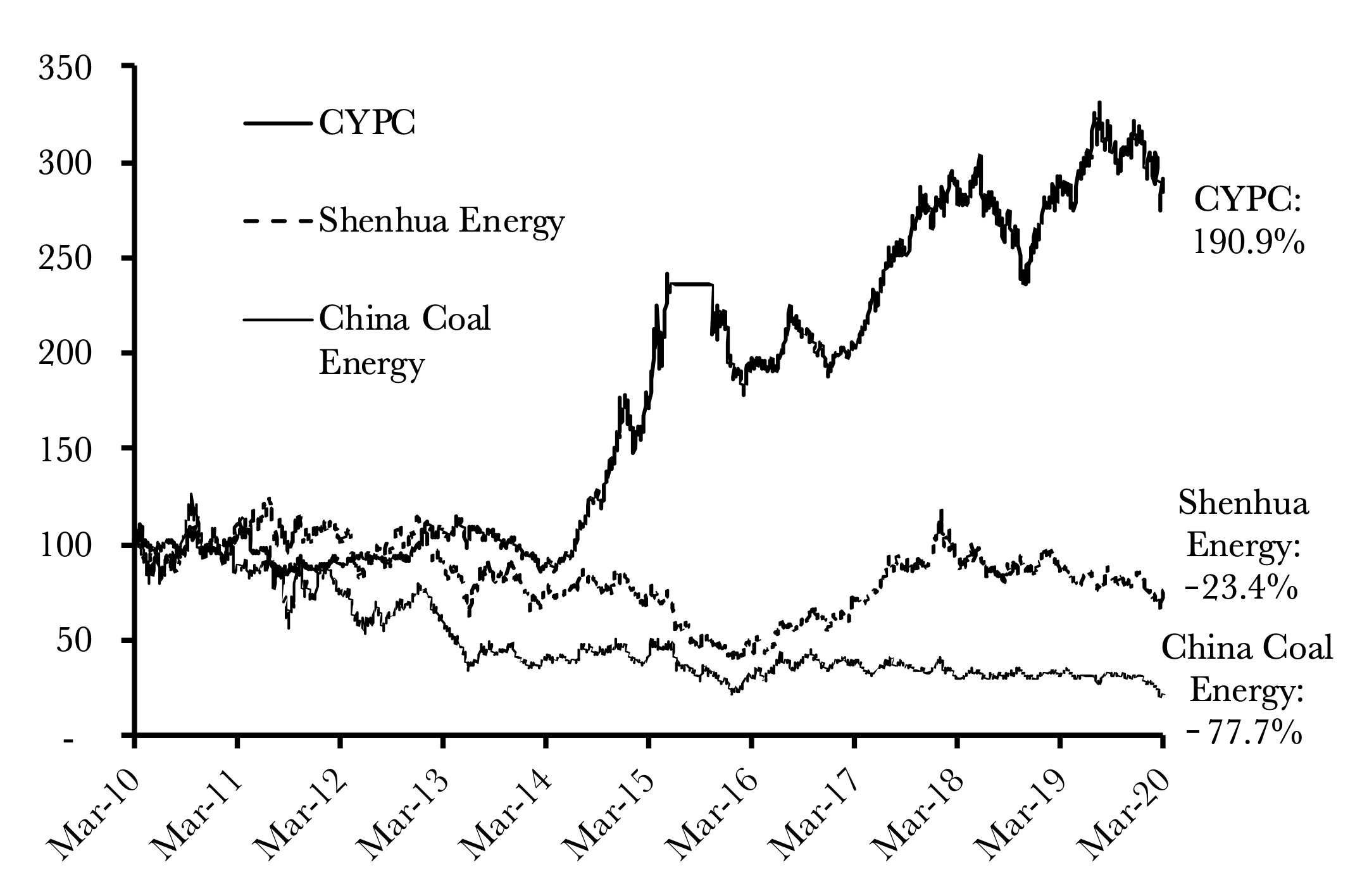

China Yangtze Power Company is the world’s largest supplier of renewable energy. It is also one of the best and most reliable generators of free cash flow in China, if not Asia.

CYPC’s Three Gorges hydroelectric dam

CYPC’s Three Gorges hydroelectric dam

The bifurcation of the Chinese companies into “the best and the rest,” and the

comparative performance of Overlook’s investments in the “best.”

The Model

Part Four – The Voices of Overlook

Chapter 12 – The Art of Selling Equities

Chapter 13 – Lunch with Overlook: An Interview with Jeffrey Lu Minfang

Chapter 14 – Hong Kong, Our Home

Chapter 15 – ESG: The Climate Divergence

Chapter 12: The Art of Selling Equities

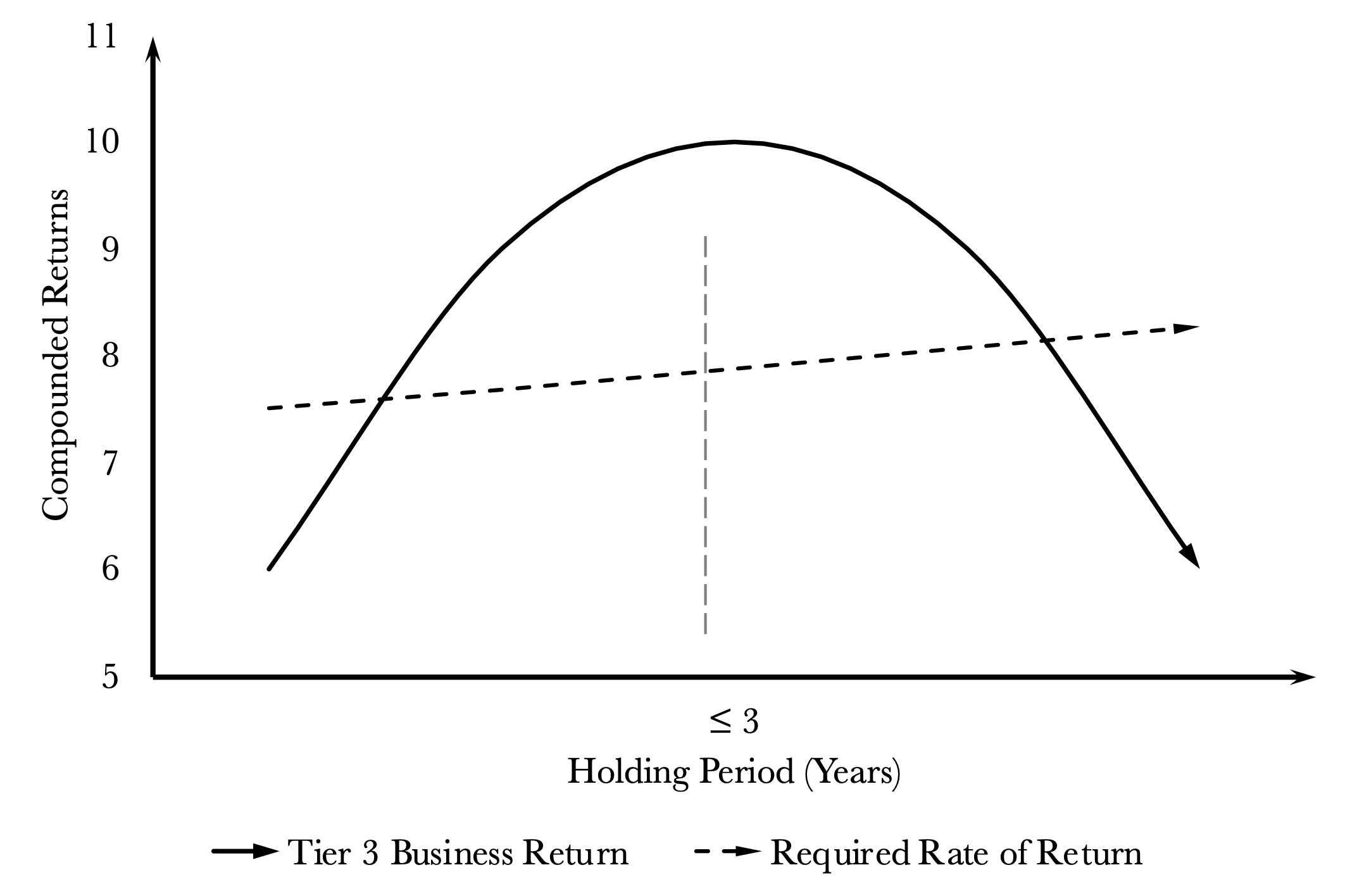

Tier 3 businesses are our least favored type of investment. Our approach here is to buy them very cheaply and expect to sell them cheaply with the knowledge that time is working against the investment.

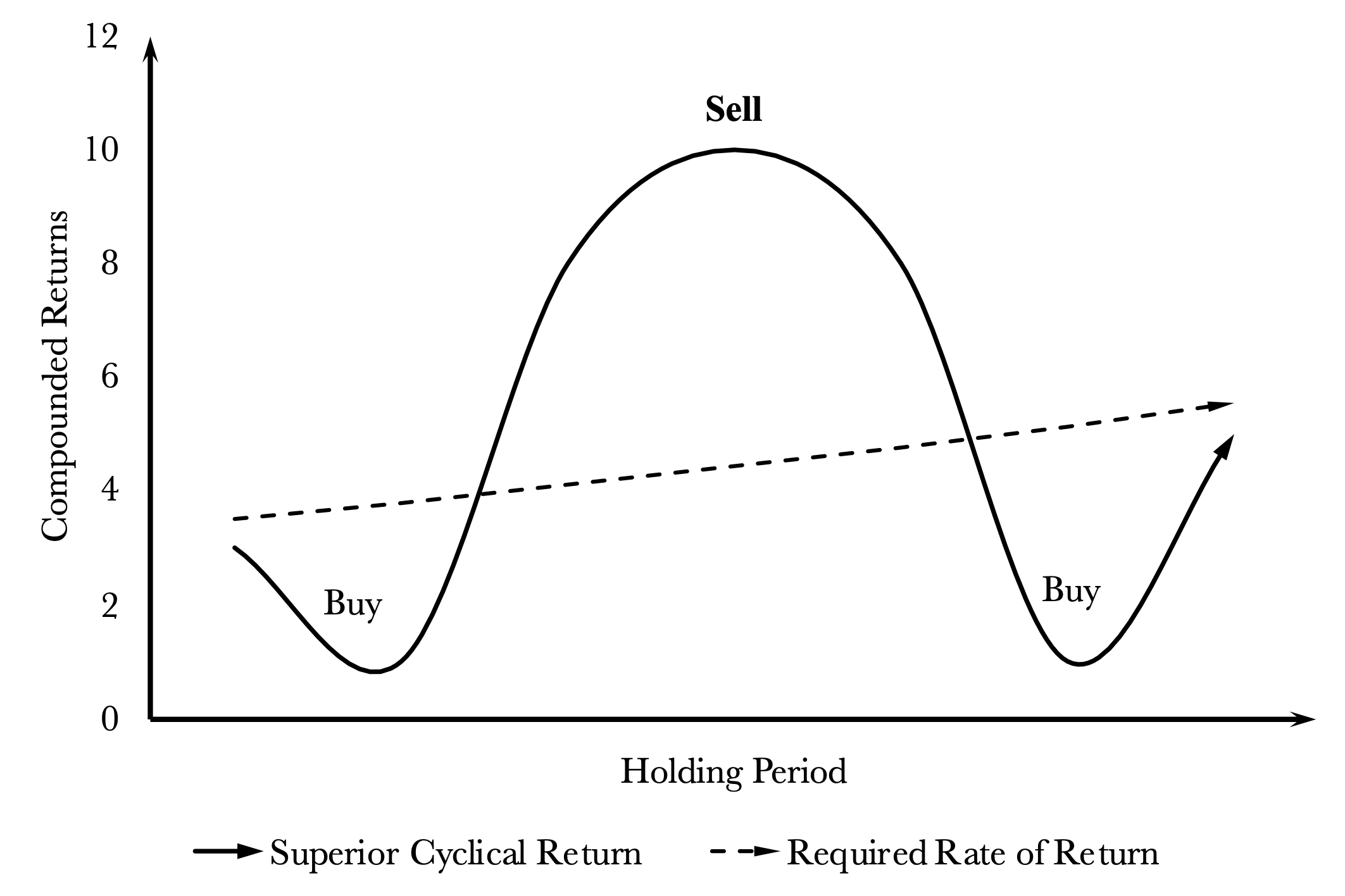

Superior Cyclicals are those companies that generate high operating returns and require limited fixed asset and working capital investment, but are cyclical in nature. The length of the holding period is largely business cycle dependent.

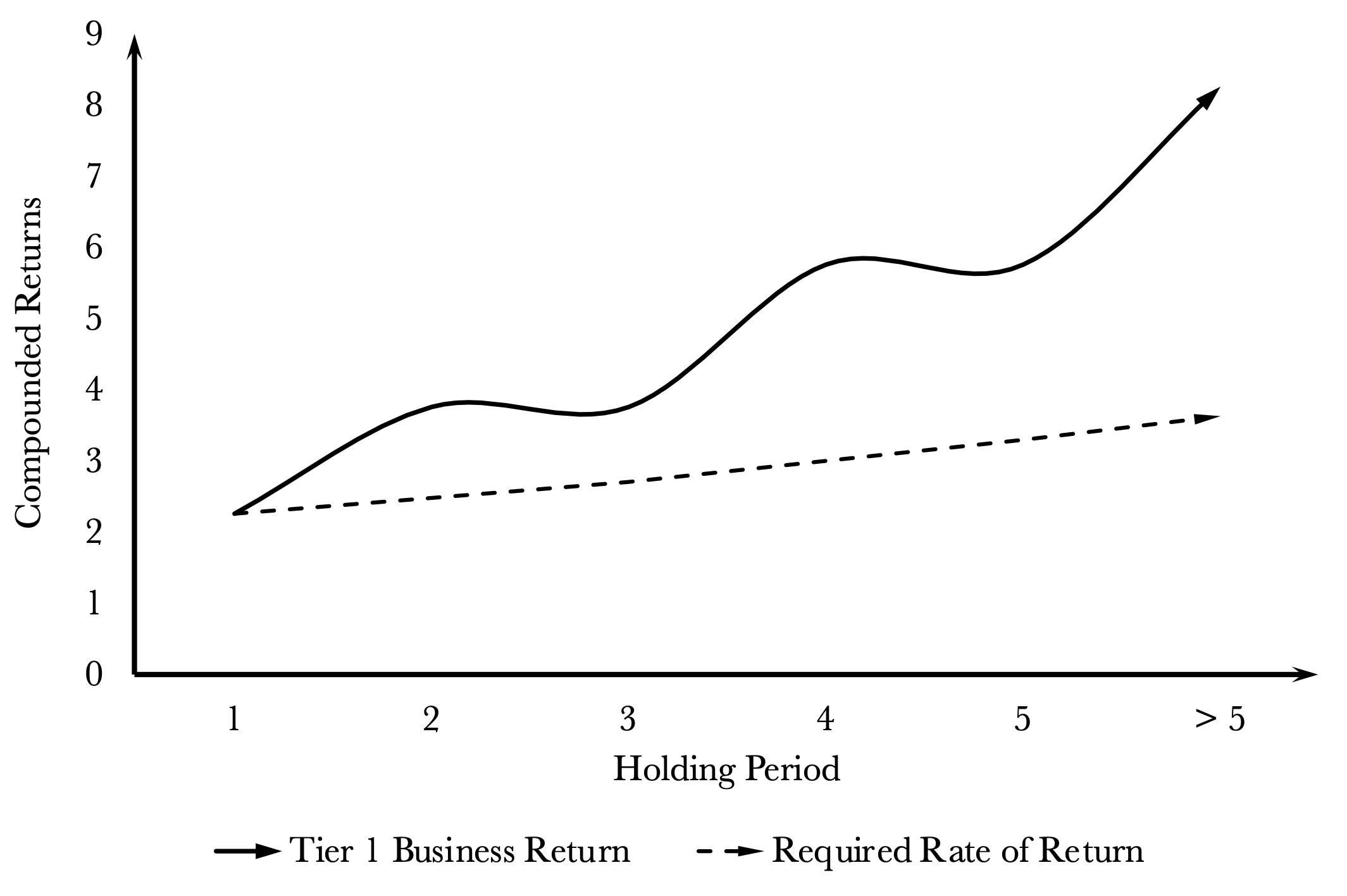

Tier 1 businesses enjoy exceptionally high returns; have low capital intensity, strong pricing power, and defensible moats; and are cash generative. One needs to be wary of selling such gems, since their duration is infinity.

Chapter 13: Lunch with Overlook: An Interview with Jeffrey Lu Minfang

Lunch With Overlook

Leonie Foong, Partner at Overlook, interviewed Jeffrey Lu Minfang, CEO of

China Mengniu Dairy Co., Ltd., over a pleasant lunch. Jeffrey, a member of the

Overlook Hall of Fame, has built strong foundations for Mengniu’s long-term

growth. The menu, of course, includes Mengniu products.

Chapter 14: Hong Kong, Our Home

Hong Kong, Our Home

“With free movement of capital, the rule of law, and a diverse talent pool, Hong Kong still has an edge which nobody can replace right now. But we have to play our cards right, and we cannot stand still.”

“Hong Kong, with its topography and the sea and the harbor, is a stunningly beautiful place.”

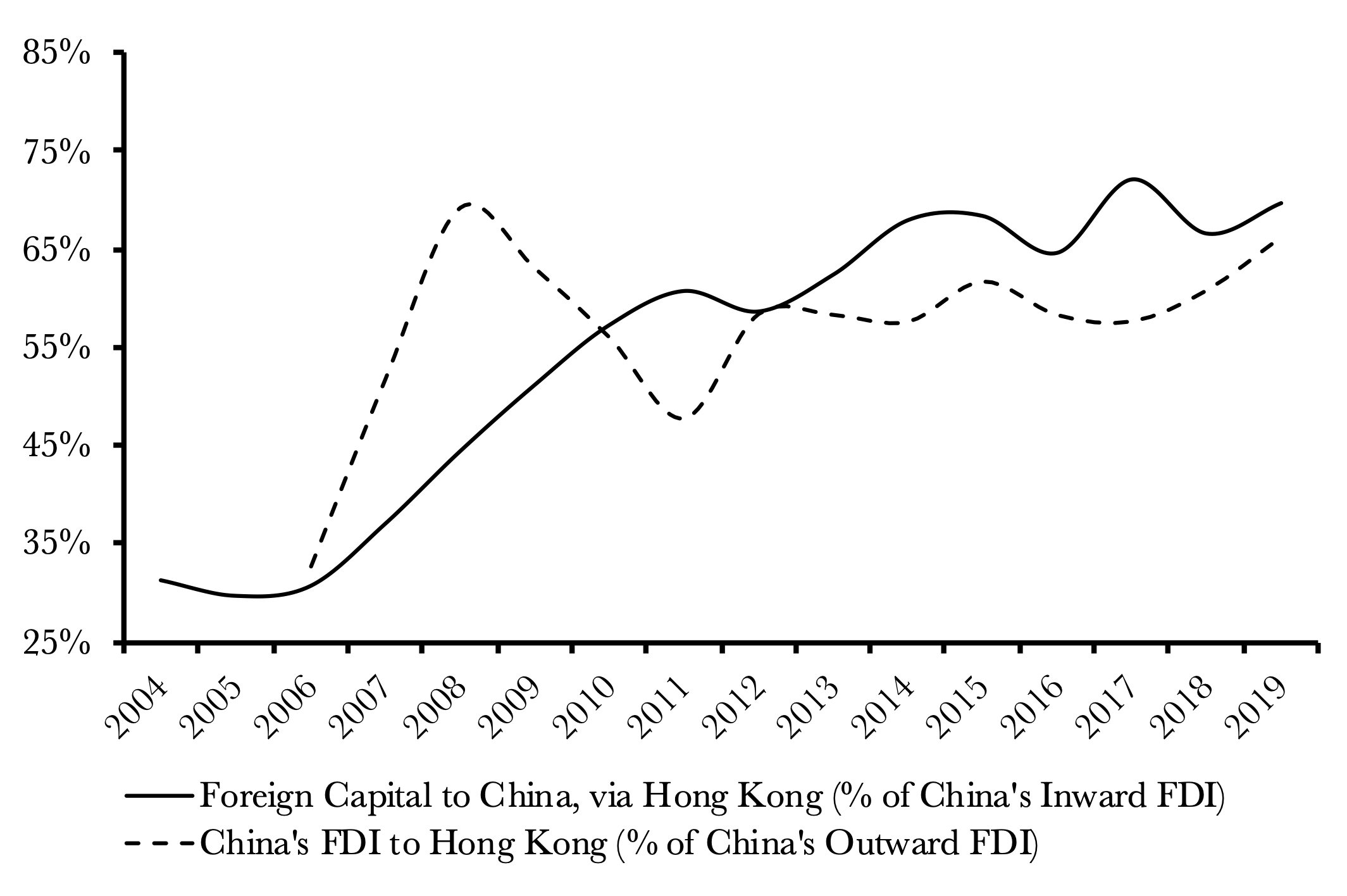

“The economic benefits are mutual between China and Hong Kong. This is why Hong Kong remains highly relevant and cannot be replaced anytime soon.”

Chapter 15: ESG: The Climate Divergence

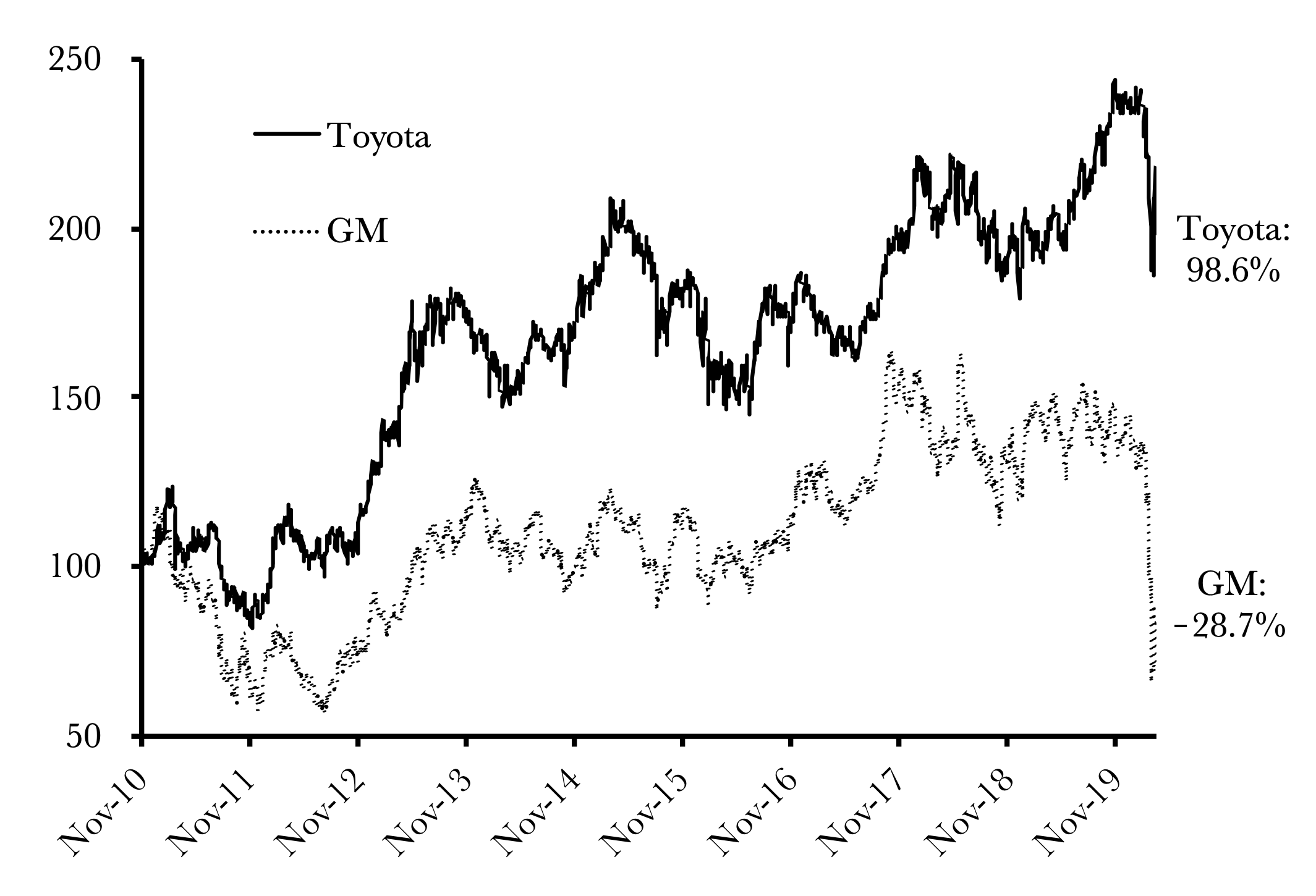

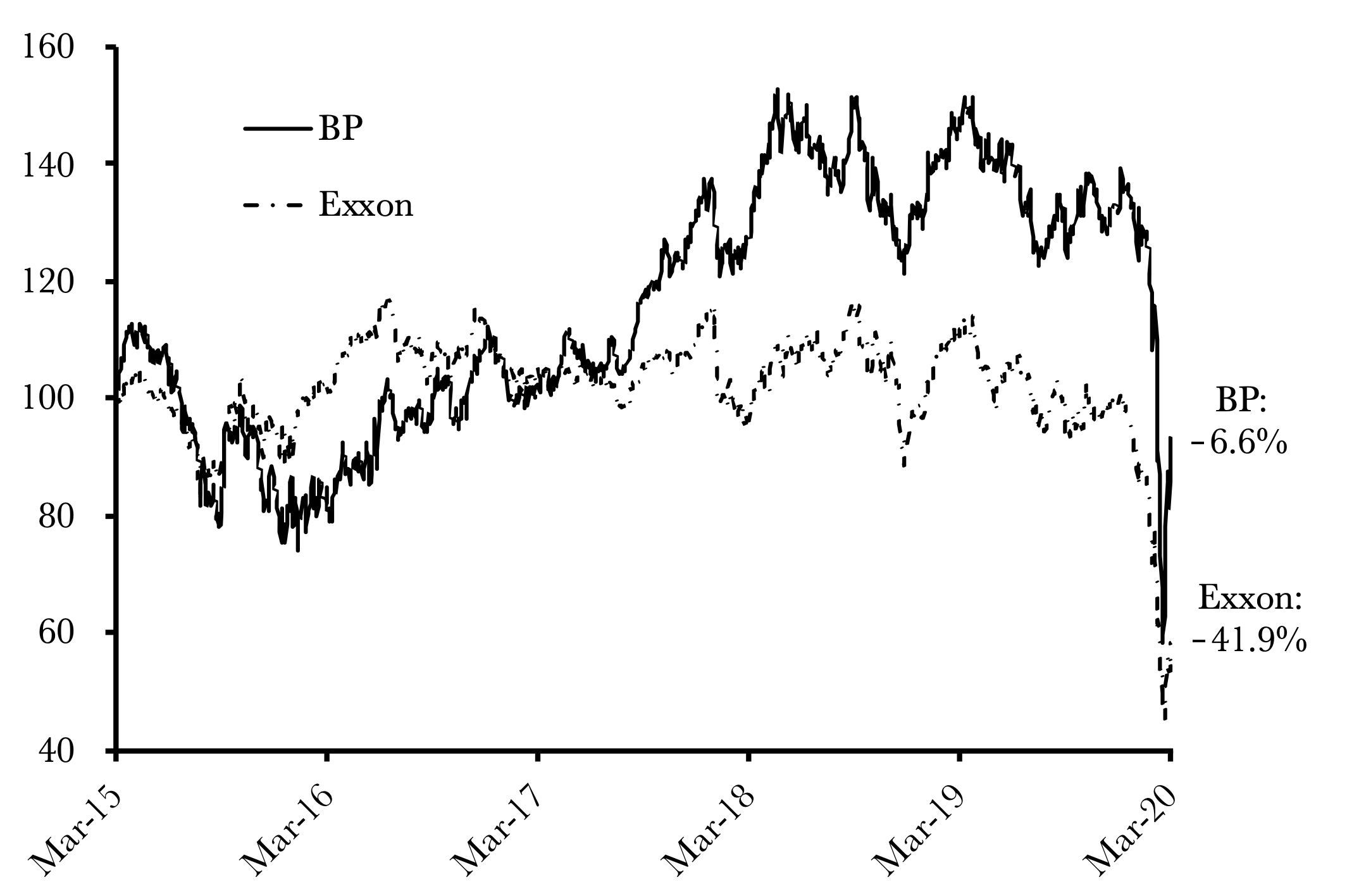

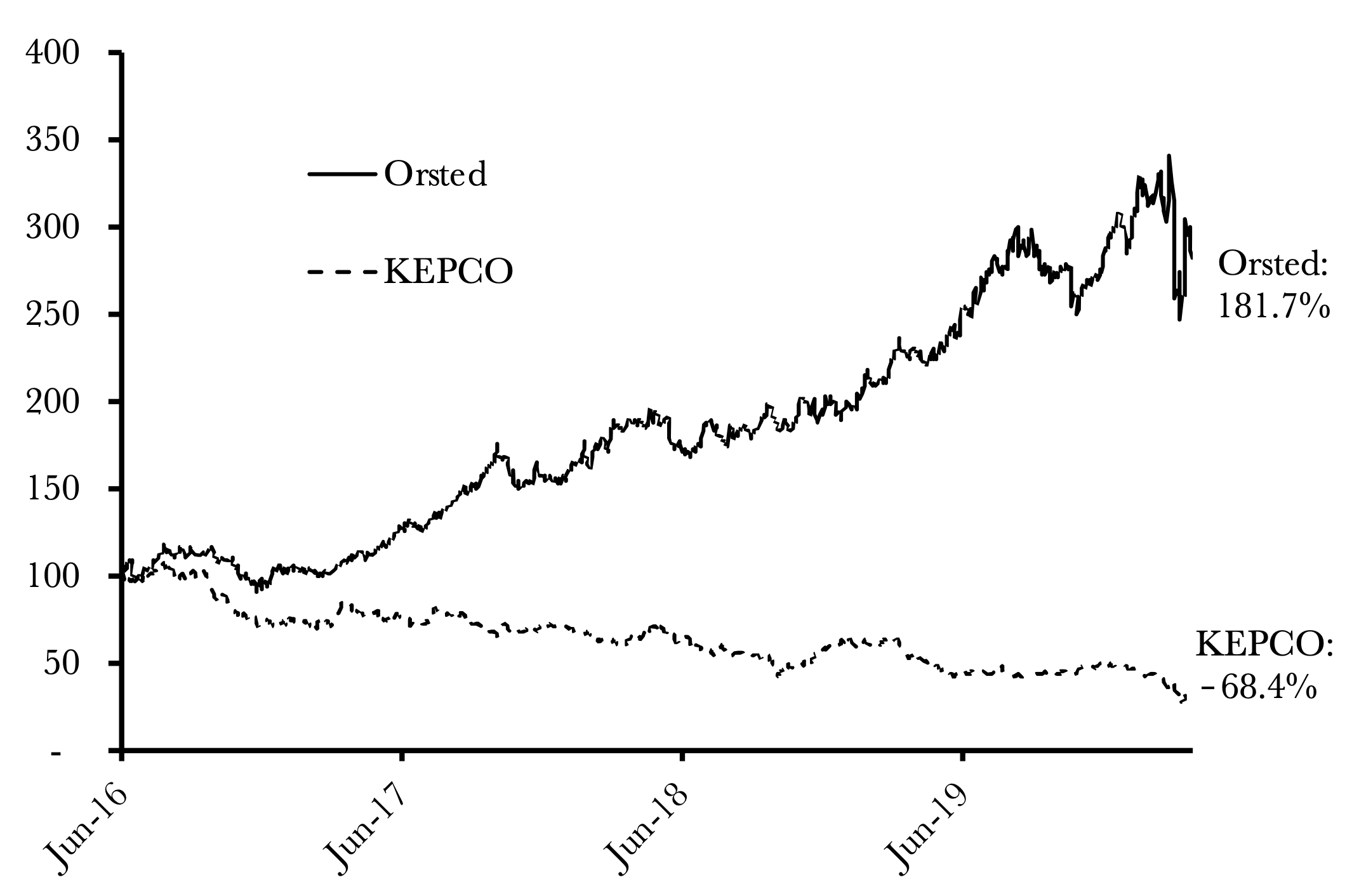

The Climate Bifurcation

Climate change is upon us, and Overlook believes that being “part of the problem” will be expensive for investors who own those stocks and being “part of the solution” will reward investors. We call this The Climate Bifurcation. Evidence of this divergence is already evident in share prices and we share a few examples above.